South Coast Commercial Real Estate Market Update

Montecito… Hot as a Pistol

Montecito’s commercial market has remained one of the bright spots on the South Coast. It seems as though Montecito is immune to rising interest rates or troubles that have bogged down other areas like downtown State Street. We are currently seeing all-time high lease rates and sale prices in Montecito. Why?

• Limited Product – There are only a few small commercial corridors, on Coast Village Road/Circle and East Valley Road.

• Small spaces – Unlike on State Street, many of the spaces are less than 1,000 square feet. And given the area’s attractive high-income demographics, renting a small space even at $7.00/square foot+ is a small monthly expense for tenants.

• Safety is not a concern for most tenants/shoppers in Montecito.

• Great retailers and foot traffic…. Chicken and the Egg. Can’t have one without the other.

• Certainty – Retailers are willing to take a risk and sign leases and undertake improvement projects as they have certainty regarding the marketplace in 1, 2, 3, 4, 5 years.

Industrial Real Estate: Incredible Recent Appreciation and High Rents

Speaking at an event five years ago, I mentioned the transition that we were seeing in Goleta and Carpinteria where industrial lease rates were in some cases higher than office lease rates. Last month two 5,000-square-foot industrial spaces in Goleta rented for more than what Class A Goleta office space is currently asking. Look for this trend to continue as our industrial vacancy in Santa Barbara remains below 1%. We have also seen Montecito residents building and leasing industrial buildings for their personal storage needs. For some of these residents, proximity and a ‘cool factor’ are more important than price.

Small Ball Leasing

It was not too long ago some of the biggest names in tech were fighting for large floorplates (20,000+ square feet) in Downtown Santa Barbara, Goleta, and Carpinteria. Landlords that could deliver big spaces were rewarded both with a great tenant and one who would improve property into Class A office space, sometimes at the tenant’s sole expense. In the current market, the smaller the space, the higher the lease rate. Most of the retail spaces on State Street are 1,500 – 4,500 square feet, much too large for today’s retailer. On the 900 Block of State Street there are 10 vacancies and all but one are 1,500 square feet or larger. Even with all the trouble on State Street, spaces under 1,000 square feet are still renting quickly for much higher lease rates. Big picture: small office, small retail, and small industrial tend to rent quickly.

New Interest Rates – New Market (Kind of)

When interest rates rise, cap rates (rates of return) typically must increase to account for the higher cost of capital. However, in a small, wealthy beach area this is not always the case. For smaller purchase prices (less than $2.5M) we have seen some impact on cap rates, but the impact is not proportional to the rise in interest rates. Apartment buildings have increased their cap rates, but only by a small amount comparatively, and the impact has been most pronounced on larger complexes.

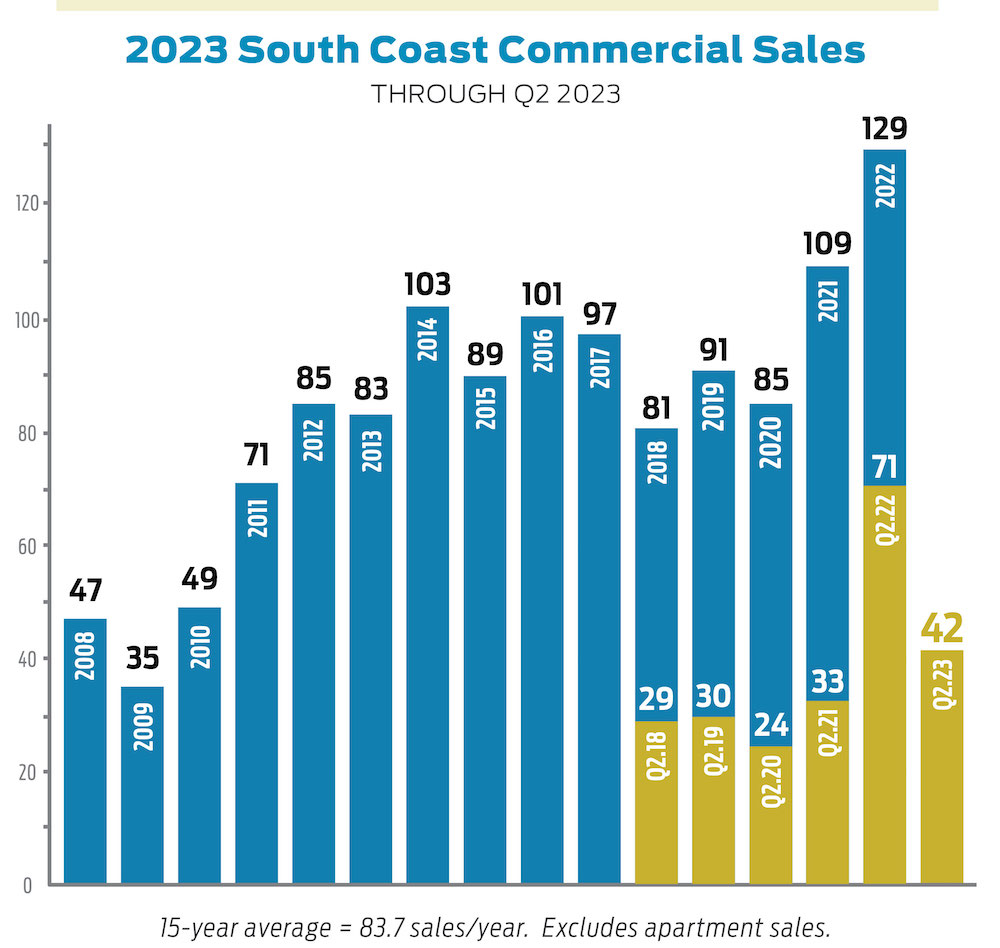

A Banner Year for Commercial Sales

Last year was record-setting for commercial sales on the South Coast (Goleta to Carpinteria) with 129 total sales (see chart). However, the start of 2023 has been more on par with our 15-year average with 42 sales transactions through Q2 (as of the writing of this report). It was not realistic to assume we could continue the momentum from 2021 and 2022.

Development – Apartments, Apartments, Apartments

Based on a shift in local and State government objectives, we have seen a significant increase in apartment buildings being constructed and entitled. There has been very little development of office, industrial, or retail buildings over the last 10 years as those projects cannot justify the high cost of land in this area. From 2019 to 2022, with cheap money, rising apartment rents, and some density bonuses, many apartment development projects moved full steam ahead. Still, with the increasing cost of capital, rising construction costs and softening rents, many projects that were previously entitled may not be built after all. As we hope for more housing in the South Coast, it is important to focus on the built and delivered unit count rather than the entitled count as each of these development projects include significant risk for the developer who is likely personally guaranteeing the construction loan.

You must be logged in to post a comment.