Nonconventional Loans on the Rise

by Adam Black

Adam Black is the area manager and senior loan officer for New American Funding Montecito branch. He can be reached at 805-452-8393 or by email adamblackgroup@nafinc.com

Being a mortgage guy, I can’t help but formulate things into mathematical equations. When I was asked to provide an update on what the biggest trends are in the mortgage market, the answer to the question is easy: the big increase in nonconventional loans. However, the explanation is a bit more complex, so I came up with the following equation:Rising Interest Rates and Home Prices + Low Inventory and Affordability Index = Increase in Credit Availability

What does this mean to the average person looking for a mortgage right now? It means there are far more ways to qualify people for loans (and bigger loans) today than at any point in the last 10 years. Even better, if you live in South Santa Barbara County where the median home price is sitting right around $1,200,000, that situation could determine whether you get to buy your house.

Now to explain the equation and what’s behind the increase in loans.

After the “Great Recession,” the Dodd-Frank Wall Street Reform and Consumer Protection Act set guidelines of what lenders needed to do to insure that borrowers could repay a loan. It also defined what characteristics a loan product could and could not include. In essence, they defined what a “conventional” mortgage is and how a borrower qualifies for one.

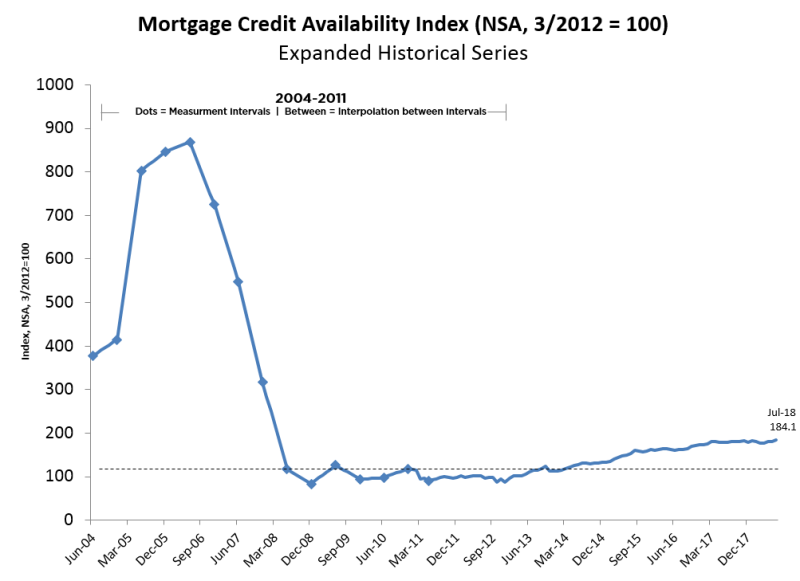

These new guidelines made it more difficult to qualify for a mortgage and eliminated loan characteristics deemed risky or onerous, such as interest-only loans and prepayment penalties. As a result, credit availability reached a low in 2008 and hasn’t seen much growth until a few years ago. This can be seen in the chart tracking the Mortgage Credit Availability Index (MCAI):

Fast-forward to today, and we have the proliferation of nonconventional mortgage products that are largely responsible for the doubling of the MCAI between 2008 and 2018 as noted above. The explanation behind why these products are being created can be understood by referencing my equation above.

Broken down, it looks like this:

• Rising Prices: home prices are up due to low inventory. Basic supply and demand.

• Low Inventory: below-average supply of houses on the market means fewer total units sold. Fewer home purchase loans for lenders.

• Affordability: is down due to the combination of higher interest rates and higher home prices, making it harder to qualify for a loan. Fewer purchase loans for lenders.

• Rising Interest Rates: interest rates are higher, so refinance loan volume is down. Fewer refinance loans for lenders.

How does all of the above add up to equal an increase in credit availability and nonconventional loans? Each factor contributes to the decrease in overall loan volume, and the only way for lenders to offset the loss is to expand credit with creative new loan products that open the door to new buyers.

New Loan Products

• Bank Statement Programs allow 6,12, or 24 months of bank deposits to be averaged for income. This has been advantageous for self-employed borrowers who write off expenses on their tax returns to minimize their tax liability but actually do quite well when averaging bank deposits.

• Asset Depletion Loans use a formula to convert assets to income to help borrowers who have significant savings but not much income or are retired.

• Low Down Payment Loan allow as little as 5% down for a loan amount up to $1.5 million.

• Adverse Credit Loans may work for individuals who have less than perfect credit or have had a single credit event such as bankruptcy, short sale, or foreclosure.

• One Year Tax Return Programs for new business owners who would not traditionally qualify if required to follow the standard of averaging two years of returns.

While there are many challenges for homebuyers and lenders in today’s housing market, the emergence of nonconventional loan programs is a positive trend, one which most industry experts forecast to continue for the next several years.

You must be logged in to post a comment.